PRC Fears Dependence on US-led Core Biotech Tools

Core tools underpin research in agriculture, health and industry. That is much of the world economy.

Written by ZhouYi Wang and Dirk van der Kley

Key takeaways

PRC firms are moving beyond scale and into tool-making. HuidaGene (辉大基因) has begun patenting newly engineered Cas proteins as a way to work around the challenging CRISPR IP landscape.

The govt tries to patch its weakest links: AI-driven protein design, DNA-encoded chemical libraries, high-quality DNA assembly kits, microfluidics and fully functional biofoundries.

Bit-by-bit China is developing its own tools.

The technologies have a serious possibility of getting caught up in US-China geopolitics.

China has turned synthetic biology (SynBio) from promise into production. From the government’s 32 critical molecules target list to the rapid rise of domestic biopharma firms, its ambitions in SynBio are backed by results.

The 14th Five-Year Plan for the Bioeconomy tasked SynBio with securing China’s future needs in medicine, agriculture, and energy. This pressure has yielded industrial champions where Cathay Biotech (凯赛生物) now supplies ~80% of the world’s long-chain dicarboxylic acids (for nylon), and Huaheng Biotech (华恒生物) produces roughly half of global alanine (for food and pharmaceuticals).

These are impressive feats of bio-manufacturing. But scale is not sovereignty. The scientific tools that enabled these products were developed elsewhere.

This is the ceiling Beijing wants to break through. The same policy documents celebrating scale simultaneously call for a “high-level self-reliance and strength in science and technology” (literally in the first sentence of the bioeconomy plan). The solution, as stated in the 14th Five-Year Plan for the Bioeconomy, is “to develop high-throughput gene sequencing and drive innovation in next-generation sequencing marked by single-molecule sequencing. Strengthen R&D in bio-detection technologies such as microfluidics and high-sensitivity methods. Achieve breakthroughs in computational design of biomanufacturing microbial strains with high-throughput screening, efficient expression, and precise regulation technologies (开展前沿生物技术创新。高通量基因测序技术,推动以单分子测序为标志的新一代测序技术创新。加强微流控、高灵敏等生物检测技术研发。突破生物制造菌种计算设计、高通量筛选、高效表达、精准调控).”

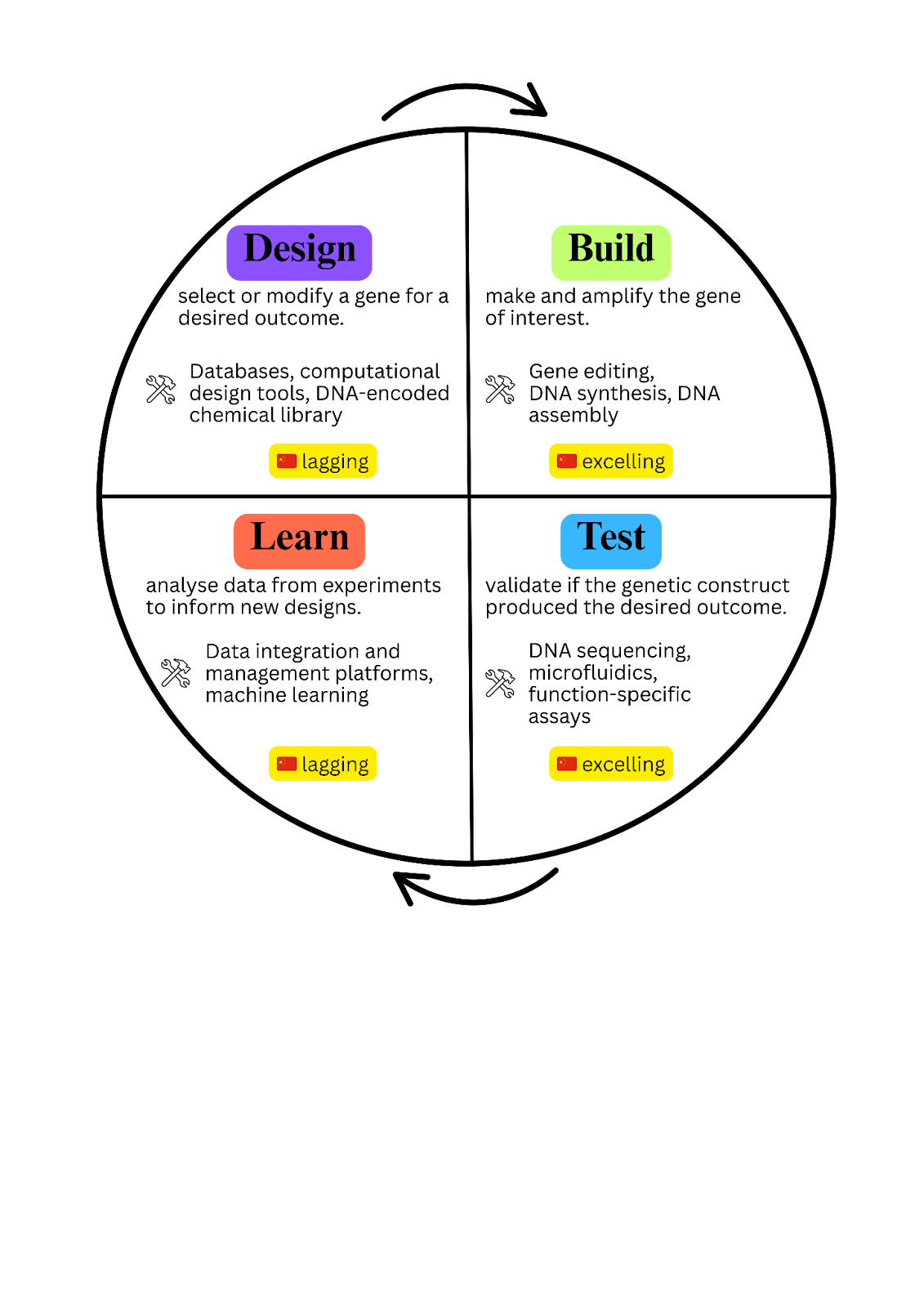

This technology wishlist outlines the higher-order capabilities of the SynBio value chain. But none of them can exist without mastering the basics first, such as gene editing, DNA synthesis, and sequencing. That brings us to the Design-Build-Test-Learn (DBTL) cycle, a framework most SynBio researchers now use. Each stage relies on specialised tools, and progress in one stage is meaningless if the others lag. For China, the challenge is to master this cycle from the ground up. If it fails, the risk is a “middle-income trap” of biotechnology: achieving volume without value, scale without sovereignty.

The Tools of the SynBio trade: A DBTL Audit

China’s progress is uneven across the DBTL cycle. Leading in one area does not compensate for lagging in another, as the entire chain is only as strong as its weakest link.

Figure 1. China’s progress in the foundational tools underpinning the DBTL cycle (integrated sources from various academic papers, reports and websites). Image created with Canva.

Design

Design is where concepts are born. It is the stage that relies most on information from databases, computational design tools, and experimental libraries.

Databases are the foundation of the Design stage because they turn raw biological information into standardised, interoperable parts. Universal Protein Resource (UniProt, Europe & US), Research Collaboratory for Structural Bioinformatics Protein Data Bank (RCSB PDB, international maintenance), and Kyoto Encyclopedia of Genes and Genomes (KEGG, Japan) serve as global repositories of annotated sequences, structures and pathways. Their strength lies in their network effect, where the more scientists use them, the more indispensable they become to the SynBio ecosystem. They feed directly into AI models like AlphaFold and create the shared language of modern molecular biology. The flip side for China is dependency. The data infrastructure that underpins global bio-innovation is largely set and maintained by Europe, the US and Japan.

In response, China has built domestic alternatives, including China National GeneBank DataBase(CNGBdb), National Genomics Data Centre (NGDC) and China National Centre for Bioinformation (CNCB). They provide the same core utilities of storing, organising and providing access to biological data (e.g., genomic and protein sequences and annotations). However, their defining feature is that they are state-directed data infrastructures designed to serve both science and sovereignty. Unlike internationally shared databases that thrive on openness, access to Chinese databases is more restricted. Although this ensures Chinese biological data fuels domestic AI models rather than enriching foreign algorithms, it comes at a cost. Restricted data access reduces integration with the global research ecosystem, limiting China’s ability to set international standards even as it strengthens sovereignty at home.

Computational design tools sit on top of this data layer. Here, the gap is stark. Western institutions and corporations lead at every level. Google’s AlphaFold revolutionised protein structure prediction, Meta’s ESMFold pioneered new methods of prediction, and David Baker’s Lab (RosettaFold, RFdiffusion) achieved true de novo protein design. These innovations have shifted SynBio from trial-and-error to rational engineering. China's efforts, while ambitious, remain in a catch-up phase. ByteDance’s Protenix and Baidu’s PaddleHelix represent serious attempts to replicate established predictive functions and provide supportive infrastructure. However, they are applications built upon US-originated algorithmic breakthroughs. China has not yet demonstrated the capacity to produce equally disruptive foundational models for generative biological design.

DNA-encoded chemical libraries (DELs) extend the design stage by transforming abstract hypotheses into experimentally testable options. Databases provide the raw biological information, computational tools generate candidate molecules, and DELs allow designs to be explored at scale before moving into the build phase. A DEL is a collection of small molecules, each tagged with a unique DNA barcode that records its identity. This makes it possible to synthesise and screen billions of compounds in parallel while retaining a digital link back to the original design. As such, DELs expand and refine the design space rather than execute a specific construct. International firms such as Philochem (Switzerland) and Vipergen (Denmark) push the methodological frontier with in vivo and cell-based screening platforms. China’s HitGen has taken a different path, focusing on scale. With a library of more than 1.2 trillion compounds and a kit-based OpenDEL service, it has commoditised screening as a high-throughput service. This strategy expands access to chemical space for Chinese researchers, but it does little to advance the frontier of screening technologies, which remains concentrated in international firms.

Verdict: In design, China is still a fast follower. It can replicate and scale existing tools, but the foundations of discovery remain shaped elsewhere. You cannot optimise what you cannot first imagine.

Build

If design is about imagination, build is about execution. This stage turns concepts into working DNA constructs through editing, synthesis and assembly.

CRISPR-Cas9 is the global workhorse for gene editing, but the patents and first-mover advantage belong to US and European institutions. The Broad Institute and the CVC consortium set the IP terrain for CRISPR, which quickly gave rise to a wave of well-capitalised therapeutic companies in the West (e.g., CRISPR Therapeutics, Intellia). In short, the West wrote the rules and then built an ecosystem around them.

China has had to play a different game. Instead of competing directly on Cas9, firms such as HuidaGene (辉大基因) have focused on engineering novel Cas variants like Cas12i and hfCas13Y. This strategy has two advantages. It reduces dependence on foreign IP, and it positions Chinese firms as contributors of original protein engineering rather than just consumers of international breakthroughs. The recent grant of a US patent for Cas12i is a sign that this approach is beginning to gain international traction. While the foundational IP landscape remains dominated by international institutions, China's rapid progress in developing these functional alternatives showcases its growing capacity for high-level bio-engineering and its determined shift from IP consumer to IP creator.

After DNA editing comes synthesis and assembly. For decades, Integrated DNA Technologies (IDT, US) has set the global standard of DNA synthesis using phosphoramidite chemistry. More recently, Twist Bioscience (US) and DNA Script (France) have pioneered silicon-based and enzymatic synthesis platforms which promise faster, cleaner and more sustainable DNA writing. Chinese firms like GenScript, Tsingke and Sangon Biotech dominate global supply for routine orders by scaling phosphoramidite chemistry aggressively. They compete on speed, volume and price, making them indispensable to the supply chain. However, the chemistry itself and the hardware innovations that will define the next generation of synthesis remain Western-owned.

Assembly repeats this story. The popular DNA assembly protocols, such as Gibson or Golden Gate, are public. However, the reagents that make them effective and reliable are not. The high-fidelity enzymes that facilitate assembly reactions and optimised kits are owned by US suppliers like New England Biolabs (NEB) and Thermo Fisher Scientific / Invitrogen. Domestic alternatives from Vazyme Biotech (诺唯赞) exist but are not yet equivalent in quality. The result is that Chinese labs can build, but their build stage still depends on imported molecular parts.

Verdict: China is catching up in build. It has mastered execution at scale and is beginning to create novel IP with Cas variants. But sovereignty is still hard to completely reach. The enabling chemistries and critical reagents that define the cutting edge remain in foreign hands, leaving China powerful in application but not yet in invention.

Test

Testing is where ideas meet reality. It relies on DNA sequencing, microfluidics and function-specific assays to check whether edits and constructs worked as intended. In this stage, China has one of its clearest wins.

Illumina (US) still dominates global short-read sequencing, while Oxford Nanopore (UK) and Pacific Biosciences (PacBio, US) lead in long-read sequencing. But China’s BGI Genomics, through its DNBSEQ platform, has created a genuine domestic alternative. At around $100 for sequencing the whole human genome, DNBSEQ competes globally on both cost and throughput, and has broken Illumina’s near-monopoly in many markets. This is not just about price. It shows China can build domestic hardware and software with international competitiveness. Novogene (诺禾致源), one of the world’s largest sequencing service providers, reinforces this strength by pushing enormous volumes of genomic data generation.

Yet the picture is asymmetrical. China is strong in short-read sequencing, but the long-read platforms remain Western-controlled. Long reads are not just a luxury add-on because they are essential for resolving repetitive regions, structural variations and haplotypes that short reads cannot capture. They make it possible to assemble genomes end-to-end without gaps, validate synthetic constructs with high fidelity, and uncover the regulatory sequences that govern gene expression. Without access to these capabilities, China can generate vast amounts of sequencing data cheaply, but it cannot achieve the precision or completeness required for frontier research.

However, sequencing only confirms genetic edits at the DNA level. To understand how these edits play out in living systems, testing must also capture dynamic cellular behaviour. This is where microfluidics comes in. Often described as “lab on a chip,” microfluidic platforms miniaturise biological experiments into micrometre-scale channels, allowing precise manipulation of fluids and cells while drastically reducing reagent costs. Their real power lies in enabling continuous monitoring of individual cells under tightly controlled conditions.

European firms like ThinXXS (Germany) and Sensific (Germany) illustrate why international players are at the frontier of microfluidics.ThinXXS has built its reputation as an OEM supplier capable of turning complex genomics or diagnostic workflows into reliable microfluidic cartridges, while Sensific extends these capabilities with platforms that combine droplet manipulation, optical precision and real-time analysis. Together, they demonstrate how international firms are moving microfluidics beyond basic chip fabrication into integrated systems that generate high-resolution data and plug directly into wider life-science applications. Chinese firms such as Dxfluidics (顶旭微控) and Dichbio (点成生物) have entered the field, but their offerings are still in the early commercialisation stage and focus largely on hardware and software development. They are beginning to supply microfluidic chips domestically, yet adoption into mainstream SynBio research remains limited. Unlike sequencing, where BGI disrupted global incumbents with a competitive platform, China has not yet translated its microfluidics activity into a globally recognised standard.

The Test stage also depends on function-specific assays, which are tailored to the purpose of a given SynBio design. These assays take many forms, from measuring expression and localisation to probing biochemical activity or testing phenotypic outcomes in vitro and in vivo. This is the decisive step that connects engineered constructs to real-world performance, turning a string of nucleotides into evidence of function. In the DBTL cycle, this is where success or failure becomes visible, and where the feedback that drives future design is ultimately grounded.

Verdict: China has matched the West in short-read sequencing but still trails in long-read platforms and microfluidics. BGI shows it can build world-class tools, yet the testing stage remains incomplete, limiting China’s ability to close the DBTL loop and move from scale to frontier innovation.

Learn

Learning is the feedback stage. It is where experimental data is standardised, integrated, and fed back into design so that each cycle of work improves on the last.

In the US and Europe, this is where dedicated platforms shine. Benchling (US) gives researchers a shared digital workspace for biological data. DNANexus (US) manages the heavy computation of genomic analysis. Synthace (UK) translates complex experimental designs into robotic instructions. Together, these platforms integrate and standardise experimental outputs into searchable, machine-readable datasets that power predictive models. The result is a data flywheel where each experiment refines the model, and each model informs the next experiment. Innovation compounds.

China lacks such infrastructure. Firms like iCarbonX integrate biological data, but they are focused on clinical applications, not SynBio. The lack of data integration platforms slows iteration through the DBTL cycle and reduces the compounding effect of the feedback loop that accelerates discovery. China is investing in AI for biology. ByteDance’s Protenix and Baidu’s PaddleHelix have produced promising algorithms for protein design and drug discovery. But without a robust, standardised data layer, these models cannot reach the scale or reliability of their international counterparts.

Verdict: China is critically weak in learn. It can generate mountains of data, but it cannot yet systematise that data into compounding knowledge. This is the single biggest constraint on China’s ability to move from scaling known products to discovering new ones.

Biofoundry

A biofoundry condenses the entire DBTL cycle into one integrated, automated platform where design, build, test, and learn are linked in a closed loop. It is here that the tempo of SynBio is set.

In the US, Ginkgo Bioworks exemplifies this model. Its closed-loop system couples machine learning with robotic experimentation, creating a self-reinforcing data flywheel. Every cycle improves the predictive models, which in turn shape the next round of experiments. The result is faster discovery, lower costs, and an engine for innovative idea testing.

China does not yet have a true equivalent. It has made strides in automation at individual stages with sequencing, synthesis, and high-throughput screening. However, these steps remain fragmented. The missing piece is integration. Without seamless data architecture and system design, these components cannot compound into a full innovation engine.

Recognising this weakness, China has started experimenting with more integrated platforms. The Shenzhen Synthetic Biology Infrastructure is one example. It has begun assembling a biofoundry platform that integrates automated systems for designing DNA fragments, microbes and functional testing into modular workcells. While still early, it reflects China’s recognition of the gap and its commitment to building the kind of unified platforms that could one day make it a leader in synthetic biology.

At the same time, China is exploring an alternative route to integration by embedding AI agents directly into experimental workflows. Projects like BioMARS illustrate this shift. Rather than treating automation as a set of disconnected machines, BioMARS assigns specialised AI roles to different parts of the process. One agent designs experiments, another executes robotic protocols, and a third oversees quality control, all connected to automated lab instruments. This multi-agent approach creates a feedback loop where hypotheses are tested, data is generated, and models are refined in near real time. Although still at an early stage, it shows China’s willingness to use embodied AI to overcome the bottleneck of fragmented systems and compress the pace of discovery from months to days.

Verdict: China lags the West in integrated biofoundries today, but embodied AI could shift the equation. If it succeeds in linking AI, robotics, and sovereign data infrastructure into a seamless DBTL loop, China could not only close the gap with Ginkgo but potentially redefine the frontier of SynBio innovation.

Figure 2. China’s SynBio technological strengths and weaknesses. Image created with Canva.