China has a target list of 32 molecules to make from non-food biomass

China sees this as a first step in broader "biologisation" of global industrial chains

ZhouYi Wang and Dirk van der Kley

Key takeaways

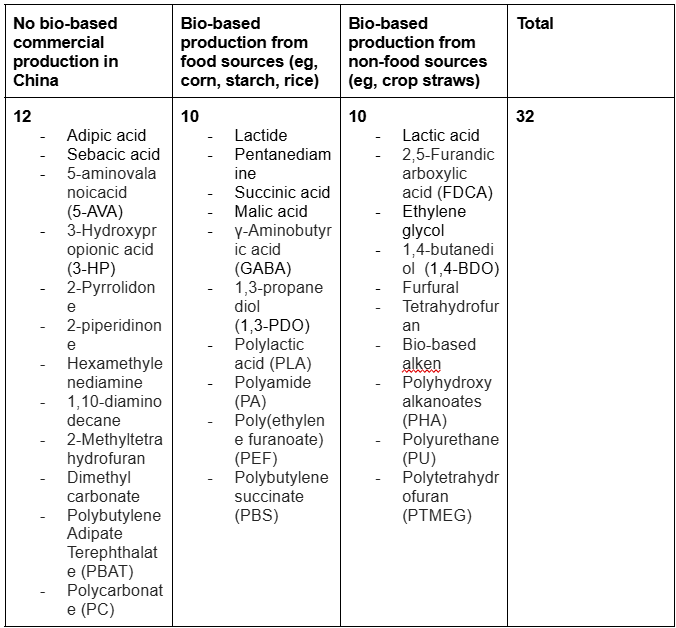

The government has a target list of 32 molecules that are mostly precursors to highly valuable commodities such as bioplastics and biofibres.

10 of the 32 targets have reached the scale of commercial production from non-food biomass. That is a big achievement in 3 years.

Some targets (eg, PLA) are already in oversupply; others (eg, 2-pyrrolidone) remain barely touched.

China still faces shortages in industrial microbe libraries which limits capability for less-studied molecules.

China’s government believes that entire industrial chains will eventually be “biologised”

For decades, China's industrialisation marched in lockstep with petrochemicals. That era is coming to an end. It started with China’s manufacturing dominance in solar cells, wind turbines and later moved to batteries and electric vehicles. The problem is now what to do for polluting sectors that cannot be easily electrified. One part of that picture is biomanufacturing - turning biomass into valuable commodities such as plastics, chemicals, fibres, and fuels. In principle, this strategy will allow China to reduce its petrochemical dependence and secure new industrial advantages.

Most bio-based production in China relies on grains like corn and rice as the primary feedstocks. This is in direct conflict with China’s longstanding priority of food security and self-sufficiency. Therefore, the long-term future of biomanufacturing requires access to cheap, reliable biomass that does not compete with food production or require large land clearing. In 2023, China announced a Three-Year Action Plan that emphasised the need to use non-food feedstocks for biomanufacturing. Six government departments jointly endorsed the strategy, signalling high-level political support.

The Plan was built on a simple calculation: China generates around 960 million tonnes of agricultural waste and 350 million tonnes of forestry residues each year (This is from a private report written by Chinese consultancy DeepTech Insights in 2023 - funded by Sequoia Capital. Snippets available here), a largely untapped resource that can be turned into valuable commodities at low cost while avoiding food security trade-offs.

In the Three-Year Action plan, the government identified a target list of 32 molecules it wants manufactured from non-food biomass. These molecules are not chosen at random. They are typically upstream building blocks of high-value commodities such as bioplastics, biofibres, solvents, and pharmaceuticals. Domestic companies have already responded, with commercial production achieved for 10 of the 32 targets. A further 10 are being produced from food-based biomass - those producers often have non-food biomass plans.

The target list provides a clear map of China’s ambitions, and some progress is already evident. Several well-studied molecules, such as lactic acid, FDCA and furfural, are being produced at commercial scales from non-food sources. This serves as “proof-of-concept” to show that it is viable to use agricultural wastes as industrial feedstocks. Yet the picture is uneven. While certain bioplastics like PLA have grown so rapidly that oversupply is becoming a concern, other molecules such as 2-pyrrolidone and 2-piperidinone, remain trapped in research laboratories with little sign of commercialisation.

China’s industrial microbe bottleneck and the molecule bubble

The reasons for this unevenness lie in structural constraints that continue to slow China’s advance. Converting raw biomass into high-quality industrial inputs is still costly compared to mature petrochemical processes (and there is a glut of petrochemical supply at the moment). The limited diversity of industrial microbes in China further restricts the ability to optimise metabolic pathways for complex or niche chemicals. This lack of microbial resources makes it difficult to scale up high-yield production beyond a narrow set of relatively simple molecules.

The future of China’s biomanufacturing industry will depend on whether these technical bottlenecks can be overcome. Expanding microbial libraries through genetic engineering, bioprospecting, and international collaboration will be essential to unlock those harder-to-make molecules (and is part of the three year plan).

At the same time, this has all the hallmarks of future “molecule bubbles” where many Chinese companies chase government-prescribed bio-based molecules - leading a race to the bottom. This will be a huge challenge for international companies trying to compete.

Molecule Watch List

The Three-Year Plan spells out a list of target molecules that can underpin everything from packaging to pharmaceuticals.

Table: The outcomes of the 32-molecule target list (for some devices, you may need to scroll right on the table to see all info)

How long can they sustain the subsidies until it all blows up though?

You are on to something here. If they pull this off and EV penetration hits 75%, boy oh boy.