🌾 Policy tools have failed to liberate 2nd gen feedstocks in the US

The US is probably behind China in commercialising 2nd gen feedstocks for bio-industrial applications

Written by Tom Campbell and Dirk van der Kley

Key Takeaways

The US has abundant biomass resources (both 1st gen and 2nd gen). Significant policy pushes over the past two decades has failed to turn 2nd gen feedstocks into commercial fuel or bio-industrial products

We do not see commercial 2nd-gen feedstock facilities popping up at the same rate in the US as in China. (We do acknowledge this misses modular approaches which we will cover separately at a later date)

The US has not developed a dedicated national strategy for implementation of feedstock policy whereas China has something akin to this for feedstocks. Consequently, the US is at risk of being left behind in the bio-revolution (at least the industrial part).

US policy has failed to advance alternative feedstocks

If biomanufacturing is to become a major part of the global economy, it needs to reconcile the competing demands of agriculture and emergent industries such as biomaterials, bio-based chemicals, biofuels and alternative proteins.

As we covered recently, nations that are preparing for the biorevolution need to find a cheap and reliable source of non-edible feedstocks - these are called 2nd generation feedstocks (1st gen feedstocks are the first wave of feedstocks usually sugar, starch, corn and other food)

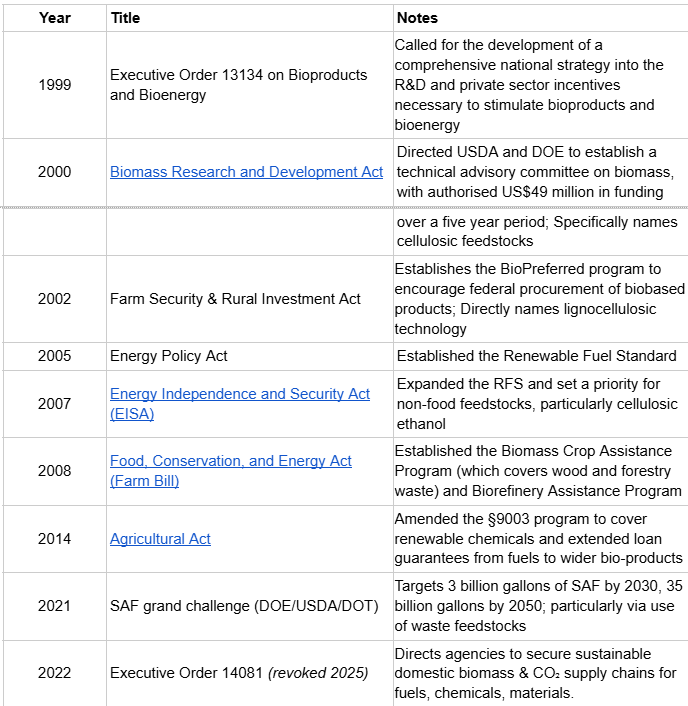

In the US, policy (notable pieces are listed below) that relates to feedstocks traditionally has been concerned with production of biofuels, and though bioproducts have been mentioned from the start (see Executive Order 13134), they remain a secondary consideration.

We can delineate the timeline of feedstock policy and usage into three chapters.

Volume mandates and tax credits for fuel blending lock in first generation corn and soybean feedstocks (2000-2007)

Quotas, loans and grants that sought to de-risk investment into next-generation feedstocks, while production of biofuels from corn and soybean oil continues to grow (2007-2014)

Broader bioeconomy policies broadens incentives for next-generation feedstocks and encourages applications beyond biofuels (2014-ongoing)

Table 1: Examples of US bio-products and biomass policies (Have just screenshot this from an upcoming report of ours)

🌱 The US is gifted when it comes to resources beyond corn

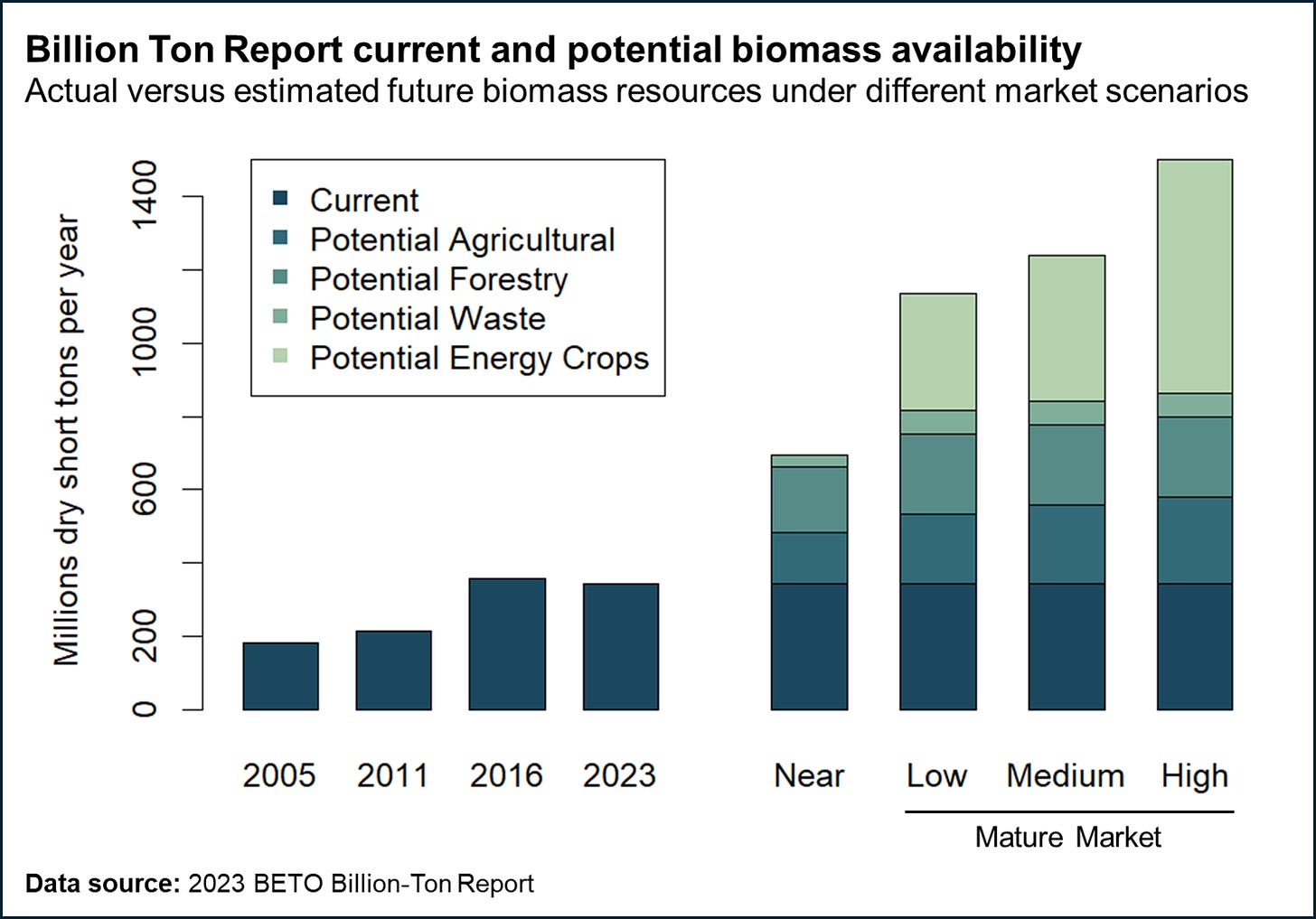

The U.S. Department of Energy Bioenergy Technologies Office (BETO) publishes an ongoing series of reports known collectively as the Billion Ton studies. Comparison across these reports (2005, 2011, 2016, and 2023) is tricky as the methodology and scope changes over time, but they show consistently that the US could sustainably produce about 1 billion tons of biomass per year by the mid 21st century - with the majority of this growth coming from purpose-grown energy crops (pg.22 of BT23 report).

The latest report suggests that near-term resources could provide an extra 350 million tons per year of biomass above 2023 usage.

While the Billion Ton reports tell us how much biomass there is, it does not constitute a strategy as it has no action plan to turn the feedstocks into products. China does have one of these. China’s plans has an explicit list of about 30 molecules that it seeks to manufacture using 2nd gen feedstocks (we have a forthcoming update on this). We are not aware of a similar plan in the US.

The stand-out statistic from the 2023 Billion Ton report is that using all projected biomass resources would cover about 15% of the US’ energy needs. This isn’t insignificant, but it also isn’t the type of contribution that makes bioenergy the best use of resources.

Of course, the big claims made by the Billion Ton report assumes major technical advances in land management and processing of next-generation feedstocks. This is where the US has a poor track record: having biomass doesn’t entail they are effective in valorising it.

🌽 Corn remains king in biofuels due to failed ambitions to diversify feedstocks

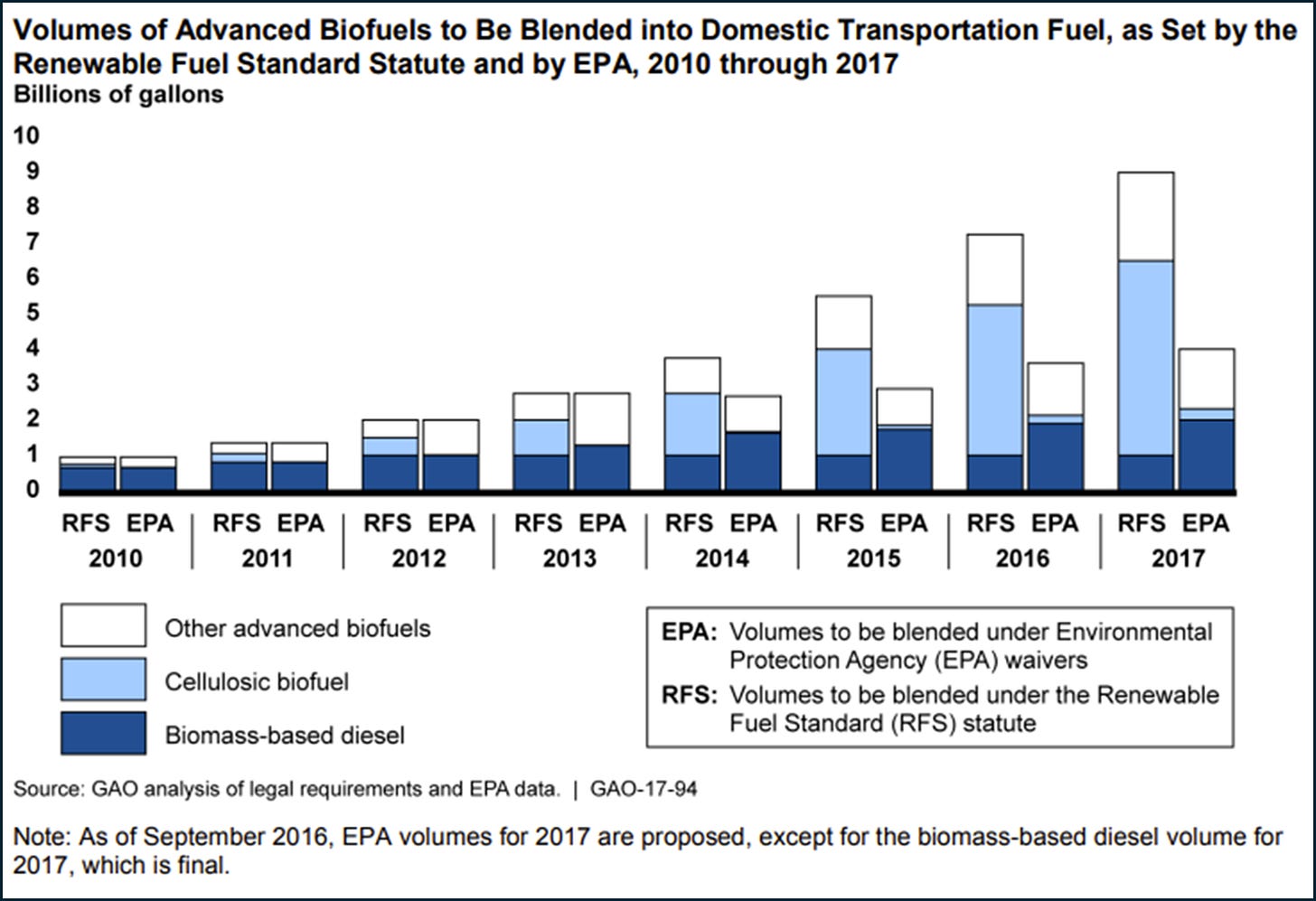

In our policy timeline, the second stage, which covers the decade from 2005 to around 2015, was associated with government spending to accelerate advanced biofuels and consequently harness non-food feedstocks.

The blunt truth is that this spending had negligible payoff. The main technology that has fallen short of expectations is cellulosic ethanol - while it was predicted to surpass corn ethanol use in biofuels, it continues to cost around 1.5-2.5 times the price.

Of course, the US is not alone in failing on cellulosic ethanol but, from our perspective, the failure of the US can be explained by three major (albeit interconnected) factors.

Low commitment to Renewable Fuel Standard RFS mandates: While non-food feedstocks and particularly cellulosic ethanol were a major part of the initial RFS mandates, the EPA has waived certain volume requirements for cellulosic biofuel every year since 2010 (see the chart below, from this report). Consequently, the status quo is that first-generation feedstocks continue to contribute to about 87% of the RFS mandates.

Limited support for supply chains: the Biomass Crop Assistance Program established under the 2008 Farm Bill was designed to provide payments to farmers delivering biomass to conversion facilities thereby derisking biomass cultivation. However, it suffered from inconsistent funding; BCAP was cut to US$17 million in FY2012 (a reduction of 96%), and has not received appropriations since 2017.

Unsuccessful commercial scale-up: US$564 million worth of funding from USDA and DOE facilitated an inaugural cohort of commercial-scale cellulosic ethanol biorefineries in the mid 2010s (e.g. DuPont, Poet-DSM, and Abengoa). None remain in operation, and the lack of a supply chain to get the biomass to these biorefineries is cited as a factor in their collapse.

Past failures like these have exacerbated the present chicken and egg dilemma facing industrial biotech in the US: demand for next-generation feedstocks will increase as industrial biotech grows, but the growth of this sector is dependent on having stable feedstock supply chains, which currently are mainly corn and soybean oil.

🏭 Industrial biotech could drive future feedstock adoption but a pivot away from first-generation feedstocks is needed

When we talk about biomanufacturing, we refer to industries beyond biofuel - think bio-based production of chemicals, bioplastics, alternative proteins, etc. The majority of these technologies are still pretty nascent but typically use corn or sugar as feedstock.

At the end of this article there is a table that is our attempt to capture the current biomanufacturing ecosystem (excluding biofuels) in the US. It is primarily based off of the IEA BioRefinery database, and a bit of our own digging - (we are working on compiling a detailed database, this is still preliminary).

One takeaway from this table is that at least in commercial-scale ventures, corn and sugar feedstocks continue to dominate. A good example of this is the DoD’s Distributed Bioindustrial Manufacturing Investment Program (DBMIP), which has provided funding for the technical planning of a cohort of 34 biomanufacturing facilities; where tentative locations for these facilities have been disclosed, there is a pretty significant bias towards the Corn Belt region. Presumably this is to take advantage of the reliable feedstock supply chains.

The FY26 Department of Defense Appropriations Act requested US$150 million for biomanufacturing, but DBIMP is not named directly and so it is unclear if existing awardees will be able to access future funds towards infrastructure.

Similarly, the first BioMADE demonstration facility to be built in Maple Grove, Minnesota will use dextrose made from corn as its feedstock.

The need to get facilities running vs 2nd gen feedstocks

The focus on first gen feedstocks is understandable. Companies need to find the shortest way to any sort of viable product. That is usually sugar. So the approach of the US is to get facilities running and then worry about the 2nd gen feedstocks later. China, on the other hand, is now looking to go to 2nd gen feedstock straight away.

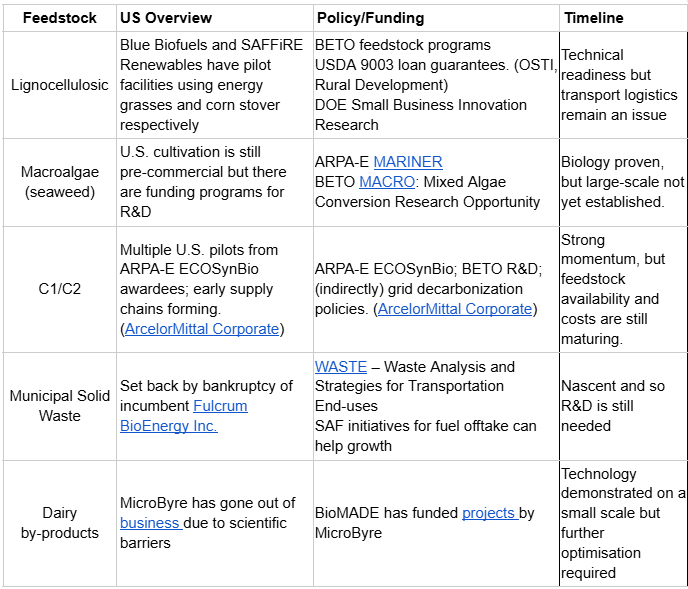

The table below summarises other feedstock types that the US has pursued/is pursuing in some capacity for biomanufacturing. In many cases, government spending on R&D is necessary to get the technology off the ground - see BioMADE’s funding of dairy waste fermentation, and food waste streams.

At the same time, logistical issues and supply chain insecurities will persist until economies of scale are established. In both cases, the government will have to play an important role in facilitating this transition.

Table 2: Overview of US feedstock efforts (Have just screenshot this from an upcoming report of ours)

We believe a lack of a cohesive strategy for biomanufacturing (which would prompt serious thought about feedstock supply chains) is seriously undermining the uptake of emergent bio-based technologies. Biden’s Executive Order 14081 seemed like a step in the right direction (several of its associated bold goals focused on feedstock supply and processing) - its rescission sends a message of biomanufacturing disinterest by the Trump administration.

While the recent NSCEB report recommends that DOE should expand programs and research on emerging feedstocks, talk is cheap - the US needs to make a credible commitment to supporting biomanufacturing or find they will find themselves off the pace of China and the EU.